.jpg)

Private Market Analytics & Valuations

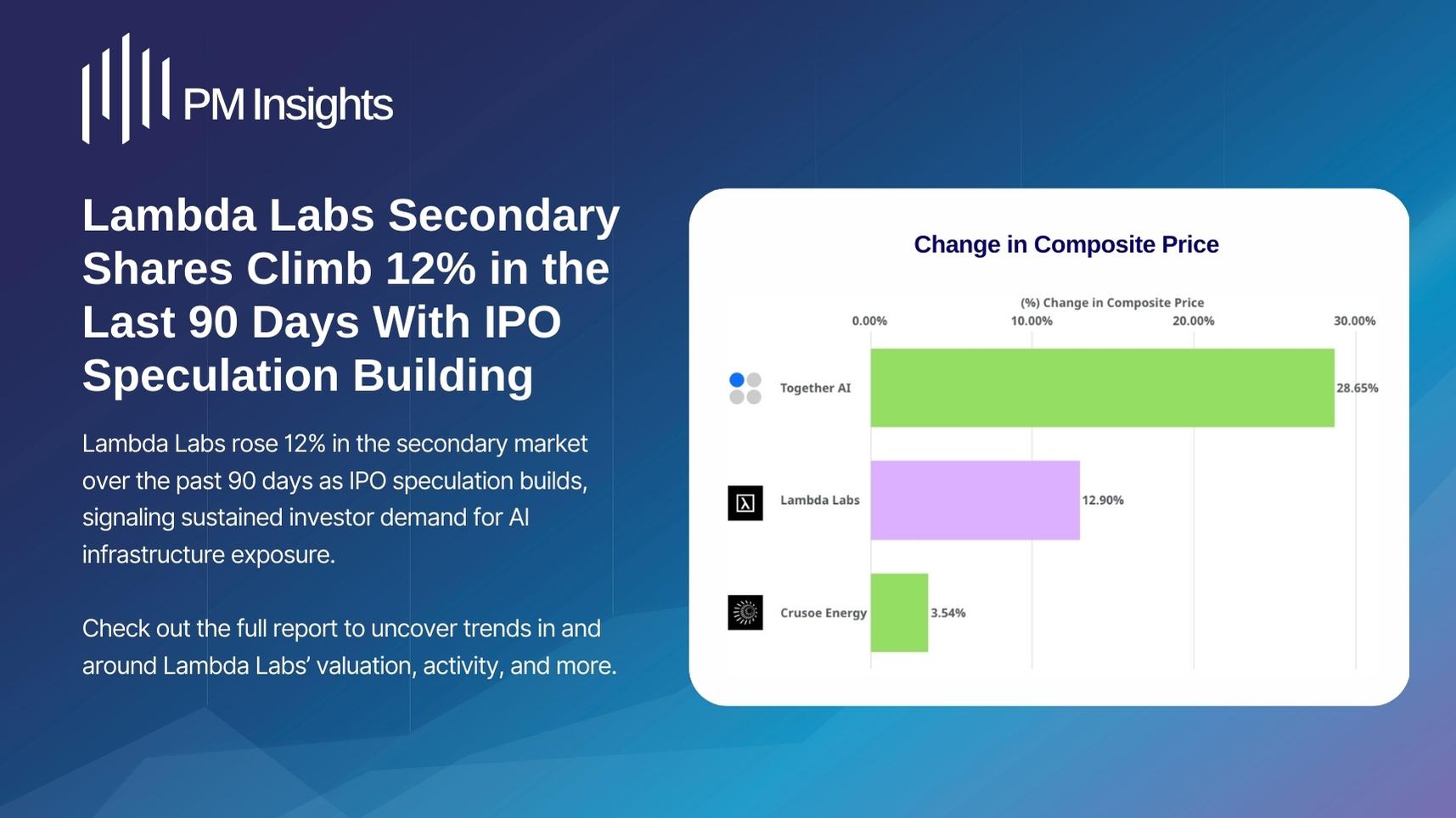

Reliable daily pricing, valuations, and performance benchmarks for private investments.

Sample data shown with delay for preview purposes. Real-time, institutional-grade datasets available to subscribers. Learn more.

As featured in

Pricing Data

Timely, reliable composite and derived stock prices

Reference Data

Tranche-level, detailed content for foolproof tracking

Indexes

Highly accurate and up to date, market & sector performance

Analytics

Private market input metrics missing from traditional factors

Confidently track, audit and value your positions in private equity as you would with any other asset class.

PM Insights’ market data helps clients understand, monitor and value private equity investments using techniques similar to those in more traditional asset classes.

Gain insights through pricing, valuations, and performance benchmarks for private investments in our custom platform

Use our SPV Calculator to analyze SPV share pricing with and without management fees, carry, and other associated costs.

PMI's SPV calculator allows private market participants to get a clearer view into the pricing across these variable fee models, aiding buyers, sellers, and intermediaries in comparing various deals on offer and, thus, better navigating this increasingly popular fund structure.

Try the calculatorOur pricing services are leveraged across sectors

Banks

Leading insights provide Underwriting, M&A, LBO, Research, and Trading teams with predictive datasets to source business and develop more competitive deal terms.

More

Brokers

Increasing broker engagement and client access by collectively supporting market liquidity through a trusted data, research and infrastructure support.

More

Investors

Empowering investors to understand the daily risks, liquidity, and market value of private investments.

More

Regulators/Auditors

Fostering reliability in private markets data and infrastructure, collective best practices are shaping the future of private markets.

More

Don’t take our word for it

Ready to see it in action?

Schedule a demo with one of our experts

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)